Integrating Digital Assets into Institutional Portfolios: Key Insights and Trends

Dec 24 | 4 mins MIN | Institutional investment

By

Kvants Team

Institutional adoption of digital assets has surged, marking a pivotal shift in portfolio management strategies. As these assets gain recognition for their diversification potential, they are increasingly becoming an integral component of sophisticated investment portfolios. This evolution reflects growing confidence in the infrastructure, innovation, and risk-return profiles offered by the digital asset ecosystem.

Key Insights

- Strategic Models: Multi-strategy frameworks and advanced arbitrage techniques are enhancing institutional portfolio performance through optimized risk-adjusted returns.

- Technological Solutions: Tools such as smart order routing and blockchain analytics are effectively addressing market fragmentation, volatility, and compliance challenges.

- Infrastructure Advancements: Innovations in custody, clearinghouses, and financial products are solidifying digital assets as a cornerstone of institutional portfolios.

- Liquidity Advantage: Digital assets provide unmatched liquidity and valuation transparency, setting them apart from traditional venture capital investments.

- Alignment with Venture Capital: Digital assets share venture capital's focus on disruption and innovation while offering real-time pricing and flexible trading.

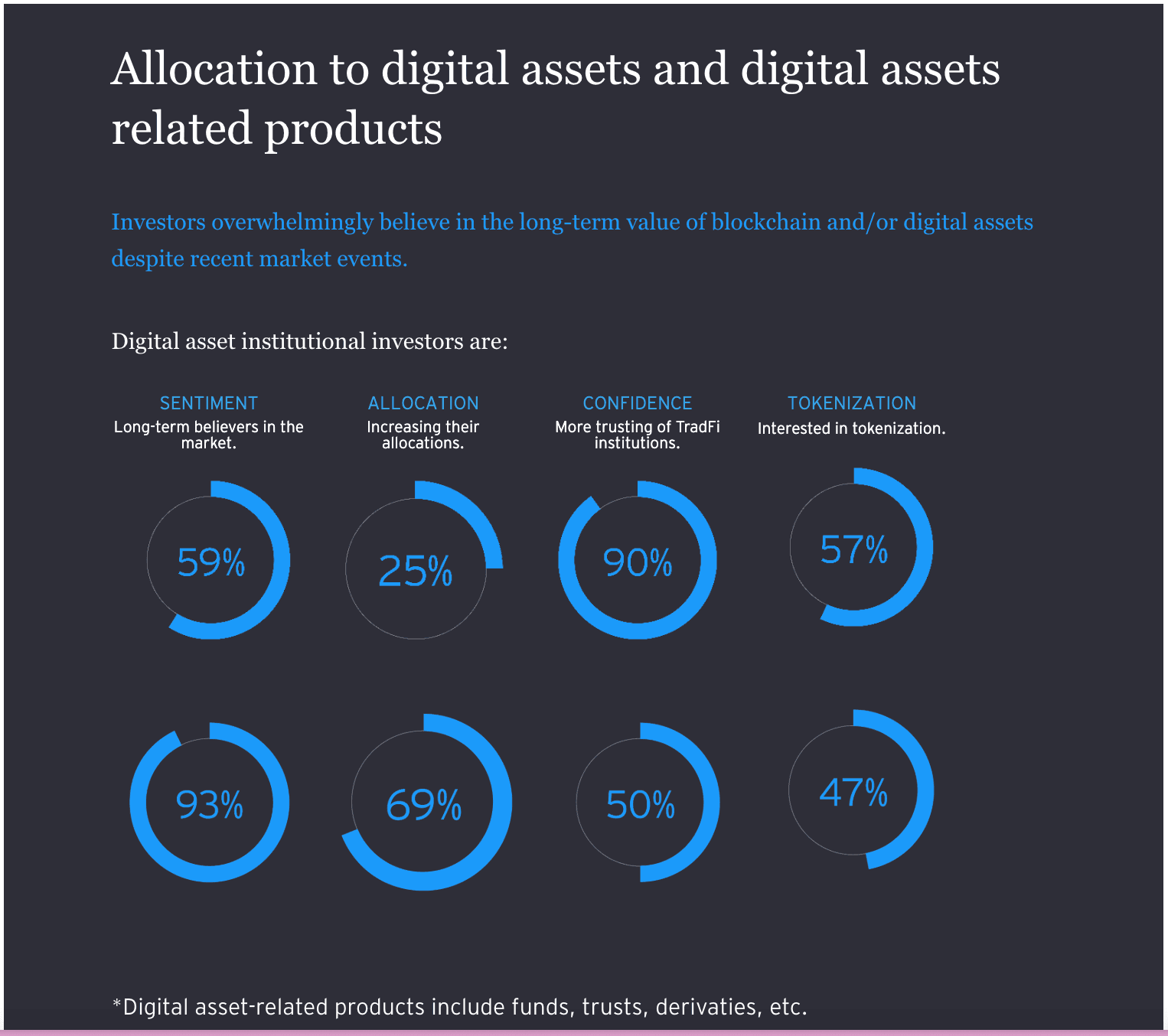

- Institutional Confidence: Increasing allocations by pensions, endowments, and family offices underscore growing trust in digital assets.

- Diversification Benefits: Digital assets’ low correlation to traditional asset classes enhances portfolio resilience and risk-adjusted returns.

- Regulatory Momentum: Key jurisdictions are introducing frameworks that reduce uncertainty and encourage broader institutional adoption.

- Prudent Allocations: Allocating 1–10% of a portfolio to digital assets balances growth potential with diversification and risk management.

Introduction

Once written off as speculative instruments for individual traders, cryptocurrencies are becoming more widely accepted thanks to improvements in technology, changing market conditions, and more transparent regulations. The advantages of digital assets, such as uncorrelated returns, diversification, and access to cutting-edge markets, are being recognised by organisations ranging from hedge funds and family offices to pension funds and sovereign wealth entities.

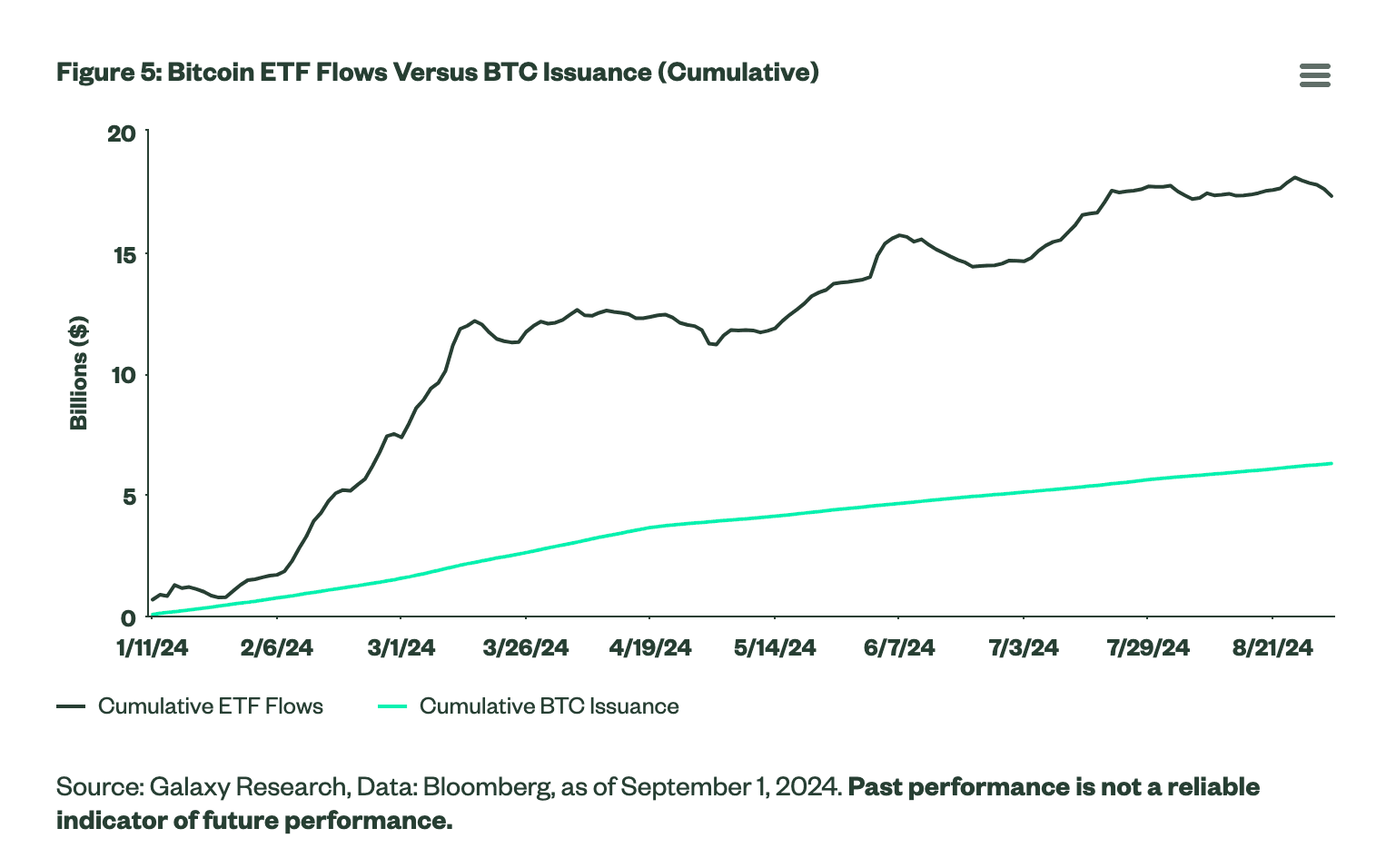

The market environment has been significantly altered by this change. Increased trading volumes and liquidity on both centralised (CEXs) and decentralised (DEXs) exchanges are being driven by institutional capital. Institutions use long-term, strategic approaches that promote market stability and lower volatility, in contrast to retail investors' momentum-driven strategies. These organisations are also at the forefront of financial product innovations, including exchange-traded funds (ETFs), tokenised assets, and derivatives designed to meet intricate mandates. In 2023, for instance, the overall volume of institutional trading on cryptocurrency platforms rose by 50%, indicating a greater level of trust and adoption in the asset class.

Developments in the Management of Institutional Crypto Portfolios

The landscape of digital assets is being redefined by institutional investors through creative approaches that mitigate market-specific risks and maximise portfolio performance. Tokenization, the use of multiple strategies, DeFi integration, and improvements in custodial infrastructure are some of the major trends propelling this change.

Over the past six years, the unusually high correlation between equities and bonds (0.61) has driven investors to explore alternative strategies for diversification. Tokenized assets, particularly those linked to alternative funds, are gaining traction as a viable solution. According to a survey by EY, 65% of institutional investors value the diversification benefits of tokenized assets, while 58% see them as a gateway to new asset types.

Traditionally, asset managers have focused on tokenizing money market funds and Treasurys, but a shift is underway, with 53% now prioritizing tokenized alternative funds. These assets not only offer potential for enhanced diversification but also play a role in democratizing access to markets that have historically been illiquid and exclusive. While cryptocurrencies have often been associated with volatility and speculative cycles, their evolving role within tokenized assets signals a broader transformation in investment opportunities.

These developments draw in more capital, hastening the ecosystem of digital assets' maturation.

Trends in Institutional Crypto Portfolio Management

Institutional investors are adopting innovative strategies to optimize portfolio performance and mitigate risks. Four major trends are shaping this evolution:

Source:EY

Growth of Tokenized Assets

Tokenization is revolutionizing asset management by enabling fractional ownership of real estate, equities, and commodities. By improving liquidity and accessibility, tokenized assets are projected to reach $16 trillion by 2030. Examples like the European Investment Bank’s blockchain bonds highlight how tokenization streamlines cross-border settlements and expands market participation.

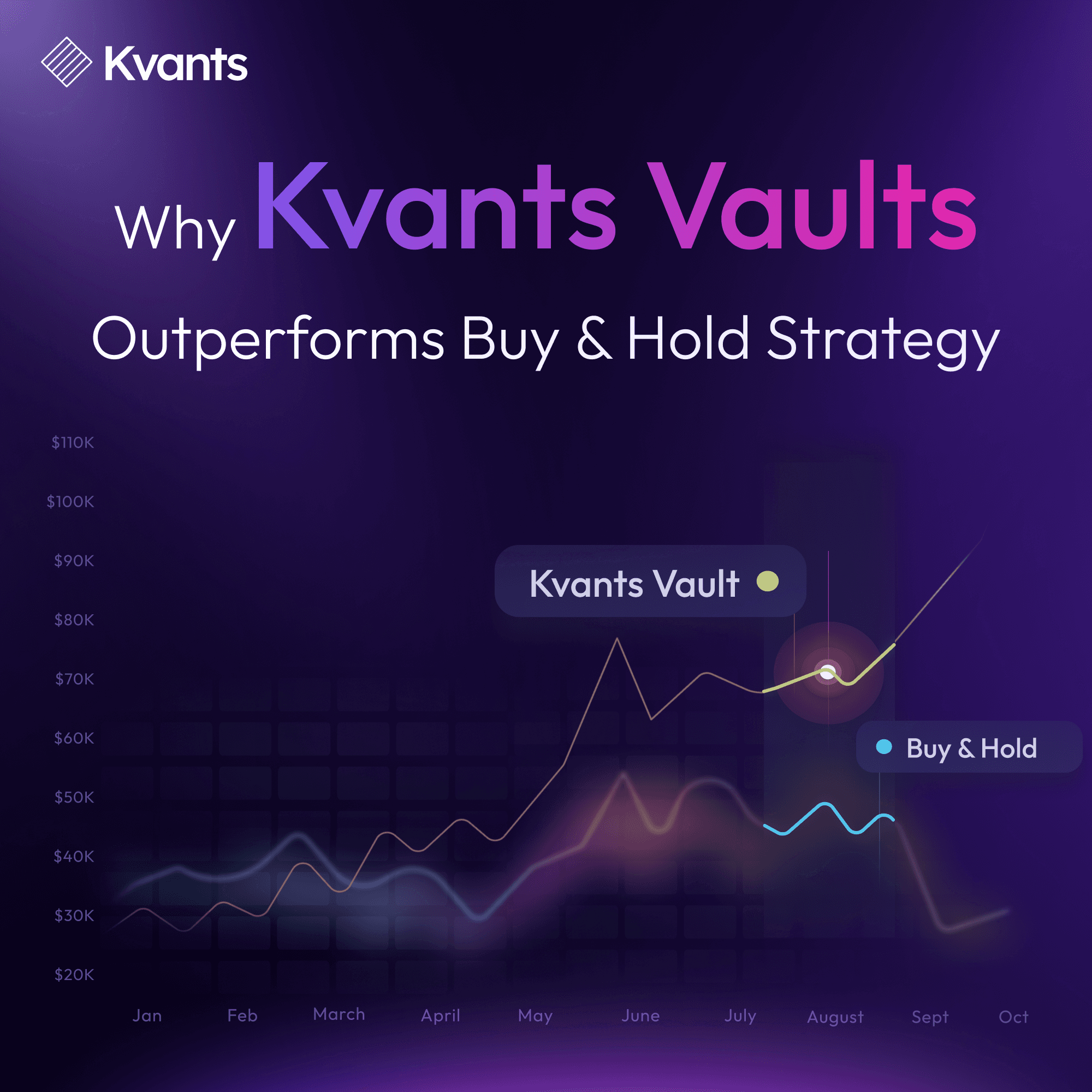

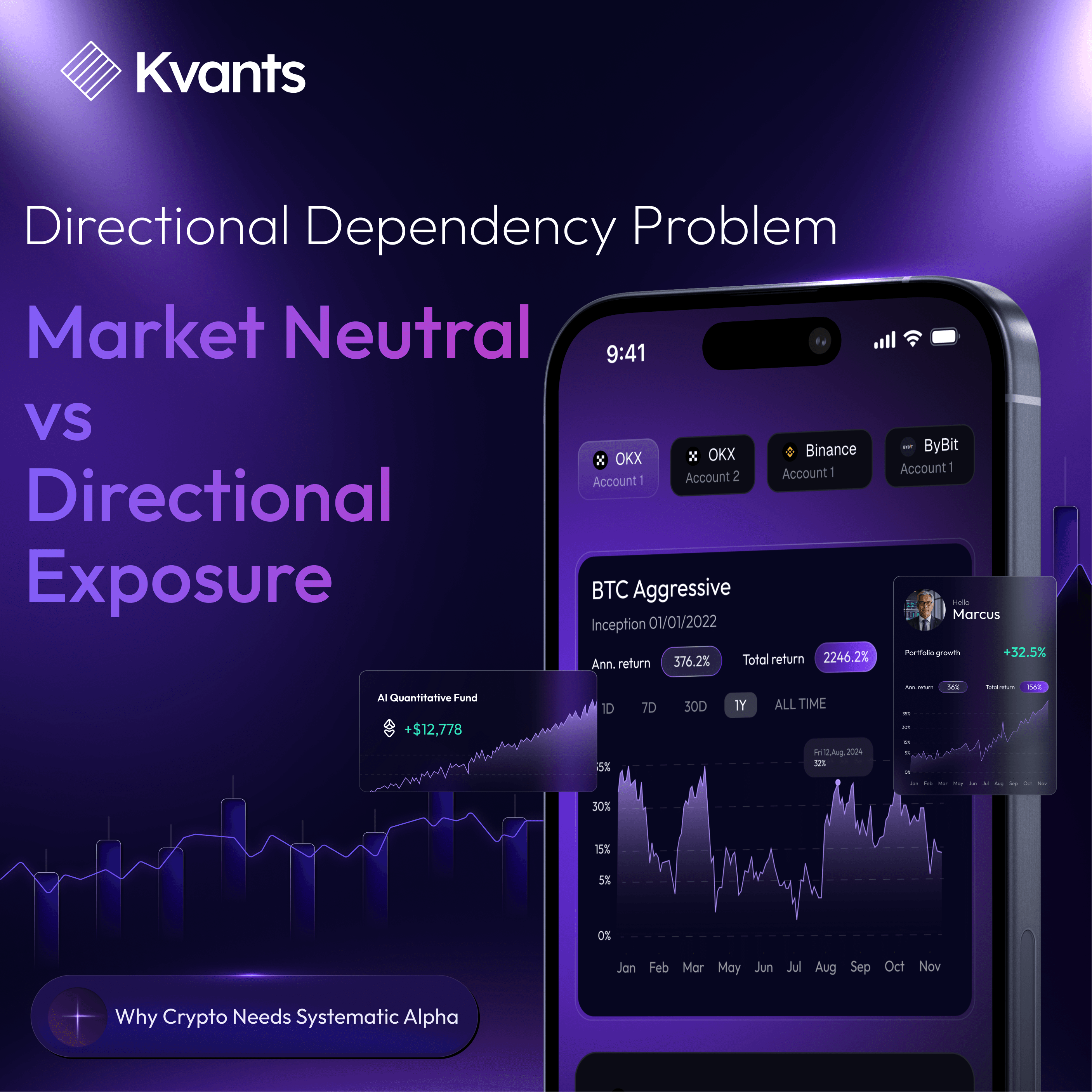

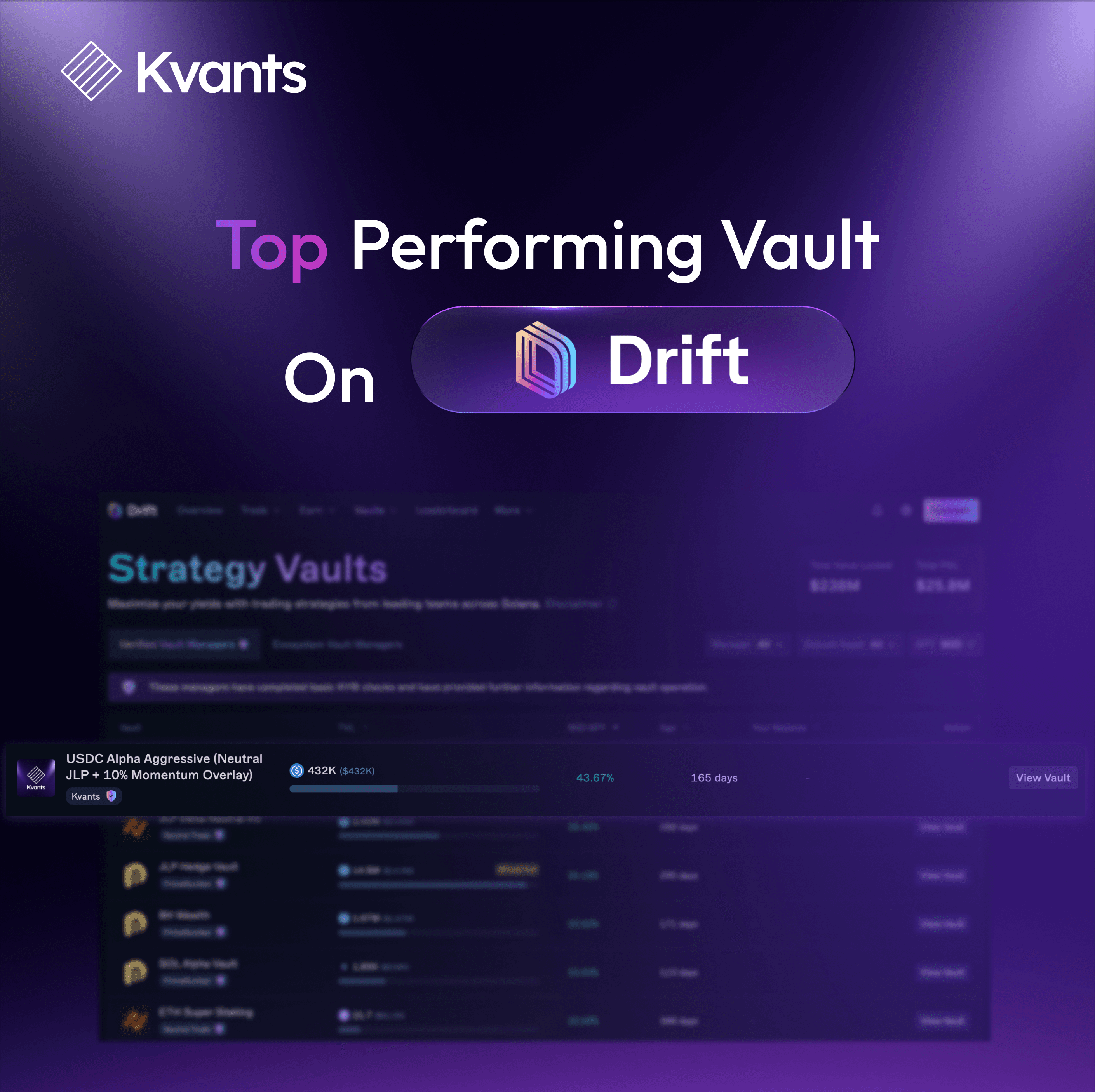

Optimizing Performance Through Quantitative Strategies

Quantitative-driven approaches are at the forefront of digital asset portfolio optimization, with multi-strategy models and advanced arbitrage techniques leading the charge. Quantitative models leverage data-driven insights and algorithmic trading to identify inefficiencies and patterns across fragmented markets. By integrating statistical arbitrage, trend-following systems, and machine learning models, institutions can balance risk and reward effectively.

These frameworks are designed to adapt to market conditions, enabling dynamic reallocation and diversification. Risk-adjusted returns are further enhanced by predictive analytics, which identify volatility patterns and optimize portfolio exposure across asset classes.

Technological Advancements in Execution and Compliance

Digital asset markets face unique challenges, such as fragmentation and volatility. Advanced technologies, including smart order routing and blockchain analytics, have become essential tools for institutions to navigate these complexities. Smart order routing ensures optimal trade execution by aggregating liquidity across various venues, reducing slippage, and maximizing price efficiency. Blockchain analytics, on the other hand, streamlines compliance with evolving regulations, enabling robust monitoring, KYC/AML adherence, and risk management. These tools not only enhance operational efficiency but also build trust within the institutional ecosystem.

Building Resilient Infrastructure for Long-Term Integration

Robust infrastructure is a cornerstone of successful digital asset integration. Institutional-grade custody solutions, featuring enhanced security measures and insurance-backed storage, are mitigating risks associated with asset safekeeping. Simultaneously, the development of standardized financial products, such as tokenized derivatives and structured instruments, is expanding the toolkit available to institutional investors. These advancements are paving the way for digital assets to serve as a foundational element of institutional portfolios.

Strategies to Optimize Digital Asset Portfolios

Institutions employ sophisticated strategies to align digital asset portfolios with broader investment goals:

1. Strategic Allocation

Allocating 1–10% of a portfolio to digital assets provides diversification, inflation hedging, and alpha generation. Portfolios are structured to balance liquidity needs and correlation with traditional assets, ensuring digital assets complement overall strategies.

2. Hedging Strategies

Derivatives such as options, futures, and perpetual swaps are used to manage downside risks and preserve upside potential. For example, Bitcoin put options hedge against price declines, while futures stabilize valuations during volatile market conditions.

3. Risk Diversification

Diversifying across uncorrelated assets, such as Bitcoin, tokenized real estate, and DeFi tokens, mitigates volatility. Predictive modeling and stress testing further enhance portfolio resilience by adapting dynamically to market shifts.

Overcoming Challenges

Integrating digital assets into institutional portfolios presents unique challenges, including market fragmentation, high volatility, and regulatory complexity. Institutions are leveraging innovative solutions to address these barriers:

- Fragmentation: Smart order routing systems aggregate liquidity and optimize trade execution across multiple venues, reducing slippage.

- Volatility: Predictive models, scenario analysis, and stress testing enable institutions to manage market fluctuations proactively.

- Compliance: Blockchain analytics and audit-ready reporting streamline regulatory adherence, reducing cross-border risks.

Digital Assets in a Venture Capital Context

The investment thesis for digital assets lies in their foundation as a disruptive, transformative technology, drawing parallels with venture capital (VC). Both asset classes thrive on innovation and the promise of significant scalability, often focusing on early-stage projects navigating the journey to product-market fit and profitability. However, digital assets introduce a critical differentiator: liquidity. Unlike traditional venture capital investments, which often require years of lock-up periods, tokens offer investors liquidity through exchanges and over-the-counter trading platforms. This characteristic has earned many long-biased digital asset strategies the moniker "liquid venture."

Despite these similarities, venture capital has a longer history and established frameworks as an asset class. Institutional allocations to venture capital have steadily increased, providing useful benchmarks. For instance, data from Cambridge Associates (2019) showed that endowments and foundations allocated an average of ~6% to VC, up from ~2% in 2001. Notably, institutions with top-decile 20-year investment performance allocated a mean of ~15%, compared to 8% in 2001. Family offices similarly allocate significantly to venture capital, with North American families averaging 15%, and larger family offices allocating even more, at 16% for those managing $500MM+ portfolios. Such data underscores the recognized value of exposure to disruptive technologies.

The growing recognition of digital assets as a proxy for disruptive technology makes them a natural complement to, or even an extension of, venture portfolios. Investors like CalPERS, Yale Endowment, and Canadian pension plans have already increased allocations to venture and, in some cases, cryptocurrencies. Digital assets, with their potential for high returns and liquidity, represent a significant opportunity to access venture-like returns while mitigating some of the illiquidity risks typically associated with early-stage investments.

Liquidity and Transparency in Digital Assets

One of the most distinguishing features of digital assets compared to venture capital is liquidity. While traditional venture investments often remain illiquid for years, digital assets can be traded 24/7 on global exchanges or through OTC platforms. Despite a downturn in volumes in 2023, spot market activity on major crypto exchanges still averaged over $10 billion per day—an impressive figure compared to the ~$100 billion total secondary trade volume for all of private equity in 2022 (averaging <$500 million per day). Notably, venture capital accounted for only 3–5% of this secondary market volume.

Liquidity in digital assets not only facilitates entry and exit but also provides real-time asset valuations through market-based pricing. This contrasts with venture capital, where valuations rely on infrequent appraisals, often masking the true volatility of underlying investments. While daily pricing in digital assets may highlight higher volatility, this transparency reflects actual market conditions rather than the "volatility laundering" described by Cliff Asness of AQR, where private market assets appear less volatile due to infrequent revaluations.

This liquidity is advantageous for both downside and upside scenarios. In downside markets, liquid positions can be adjusted quickly to limit losses. Conversely, in upside markets, liquid assets enable investors to rebalance portfolios efficiently, maintaining alignment with target allocations without the need for costly intermediaries or discounts often required in private equity secondary transactions.

The infrastructure supporting digital assets has become increasingly sophisticated, with 24/7 trading, advanced custody solutions, and real-time pricing. This level of accessibility and transparency rivals, and in some cases exceeds, even the most established liquid markets.

Digital Assets as a Secular Bet on Disruption

Investing in digital assets is akin to making a bet on the next major evolution of the Internet and the financial system. Blockchain technology and cryptocurrencies promise to redefine fundamental concepts of money, value, ownership, and business structures. These technologies enable decentralized, permissionless networks that support new business models and improve operational efficiencies across industries.

As with any disruptive technology, adoption takes time, and the crypto market has faced its share of growing pains. However, the long-term potential remains immense. Decentralized networks, powered by digital assets, have the flexibility to integrate into existing businesses or create entirely new ones. As blockchain infrastructure becomes faster, cheaper, and more efficient, its applications will expand, driving adoption across corporations and society.

Furthermore, as regulators in key jurisdictions such as the UK, EU, Dubai, Singapore, Japan, and Hong Kong establish clearer frameworks, uncertainty will diminish, unlocking broader institutional participation. Innovations in privacy, security, and user experience are also set to accelerate crypto's journey into the mainstream.

Portfolio Allocation to Digital Assets

Digital assets offer investors an opportunity to diversify portfolios with an asset class that exhibits low correlation to equities, fixed income, and traditional alternatives. They combine the high-growth potential of venture capital with the added benefit of liquidity.

A prudent allocation to digital assets within a diversified portfolio could range from 1% to 10%, depending on an investor's goals and risk tolerance. While broad, this recommendation reflects the varying roles digital assets can play—whether as a hedge against inflation, a bet on technology-driven disruption, or a source of uncorrelated returns.

Within digital assets, diversification remains underutilized. Strategies that combine exposure to tokens, DeFi, and tokenized real-world assets can mitigate risks while capturing the full spectrum of opportunities. Actively managed, diversified portfolios are particularly compelling, as they can adapt dynamically to market changes while optimizing risk-adjusted returns.

The Future of Institutional Crypto Portfolios

As the digital asset ecosystem continues to mature, three pivotal developments are reshaping institutional portfolios. Enhanced infrastructure, including clearinghouses, insurance-backed custody solutions, and standardized valuation frameworks, is significantly boosting security and operational efficiency. Simultaneously, financial product innovation, such as tokenized derivatives and crypto ETFs, is bridging the gap between traditional finance and digital assets, enabling tailored risk-return profiles that cater to institutional needs.

Long-Term Investment Outlook

Digital assets represent a secular bet on the future of money, value, and ownership. Bitcoin and Ethereum are increasingly seen as inflation hedges, while tokenized real-world assets unlock new investment opportunities. Institutions are well-positioned to capitalize on these transformative opportunities as adoption grows.

Conclusion

Digital assets represent a transformative opportunity for investors seeking exposure to the next wave of disruptive technology. Their unique combination of liquidity, transparency, and growth potential makes them a natural complement to traditional venture capital. While challenges such as volatility and regulatory uncertainty persist, they are offset by advancements in infrastructure and increasing institutional adoption.

Investors should look beyond recent market performance to assess the long-term value digital assets bring to a diversified portfolio. With allocations ranging from 1% to 10%, digital assets can offer compelling risk-return profiles and significant diversification benefits. For institutions willing to embrace this innovation, digital assets provide an opportunity to participate in the future of money, value, and business—on a global scale.

Read more