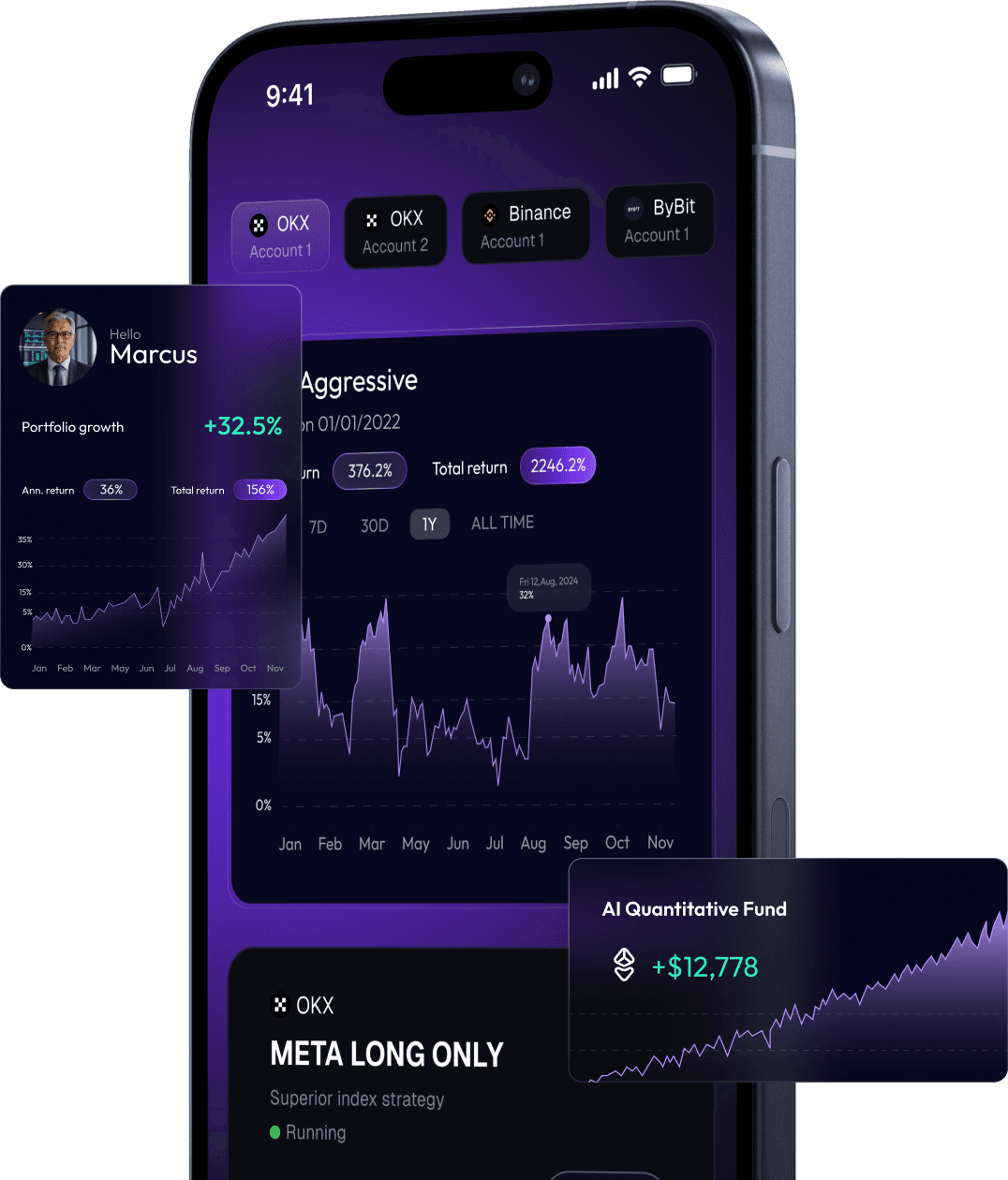

#AI Powered Quantitative Asset Management

Kvants is Bringing Automated AI Driven Quantitative Strategies to Everyday Investors.

Unlock Growth with Quantitative Trading

Click to Compete

Earn Points and Airdrop Rewards in Our Telegram Mini-App

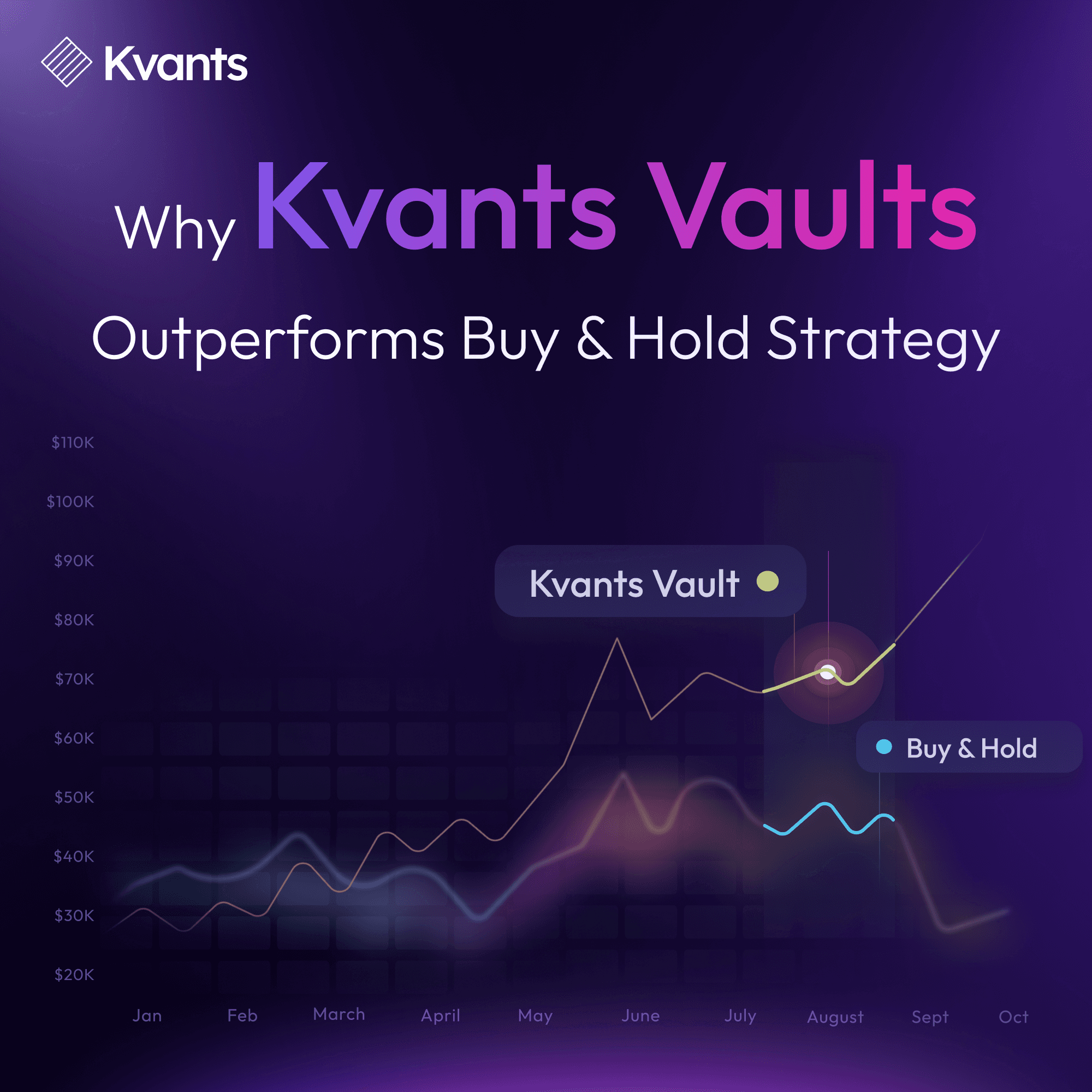

Discover Strategies That Outperform the Market

Quantitative Trading in Digital Assets

Select a Quant Strategy

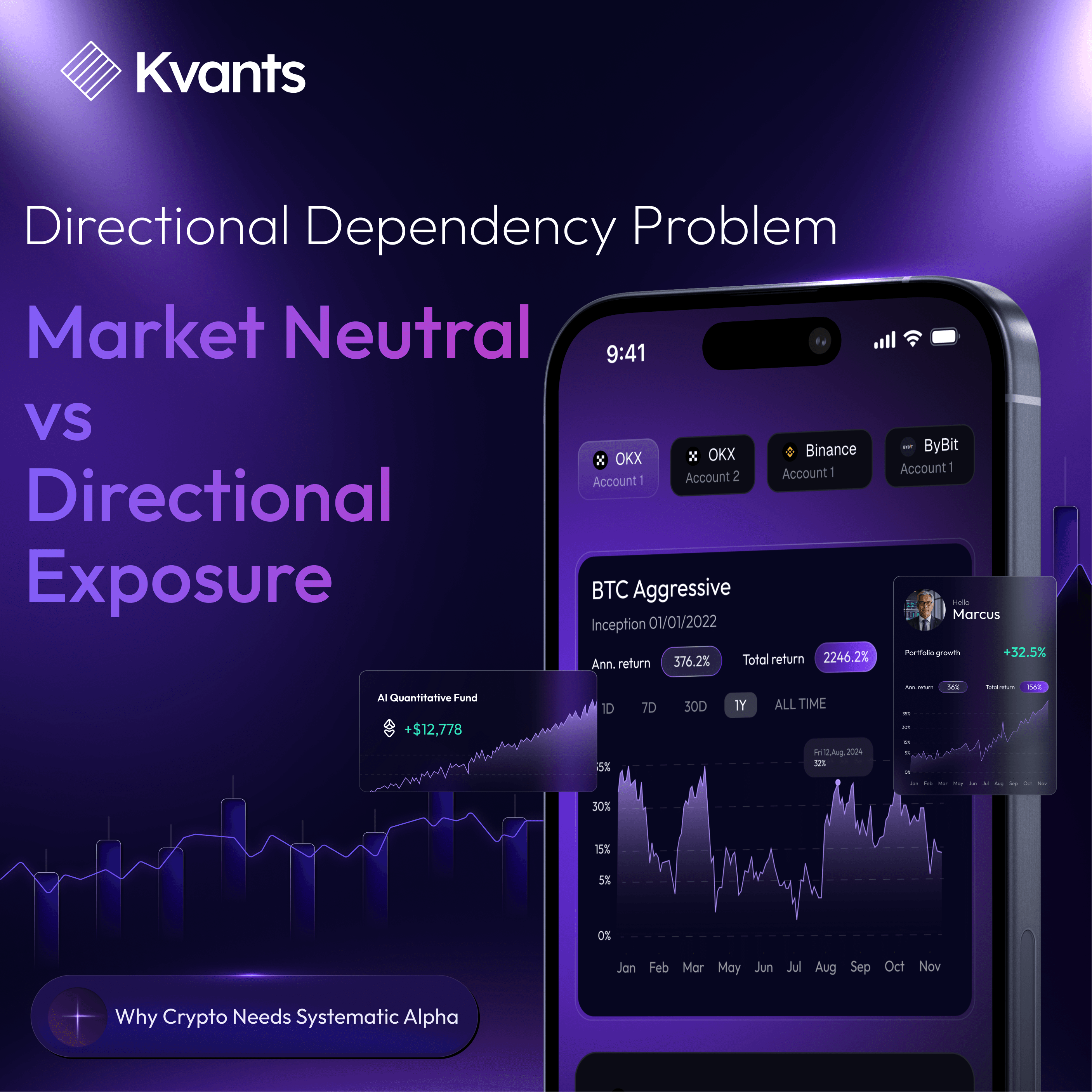

Choose from Market Neutral, Earn, Directional, Momentum, Statistical Arbitrage and others.

Hold and Earn

Grow your portfolio on autopilot with automated institutional-level AI trading strategies by holding $KVAI Tokens.

DAO & Governance

Hold KVAI Tokens to participate in DAO governance and decision-making.

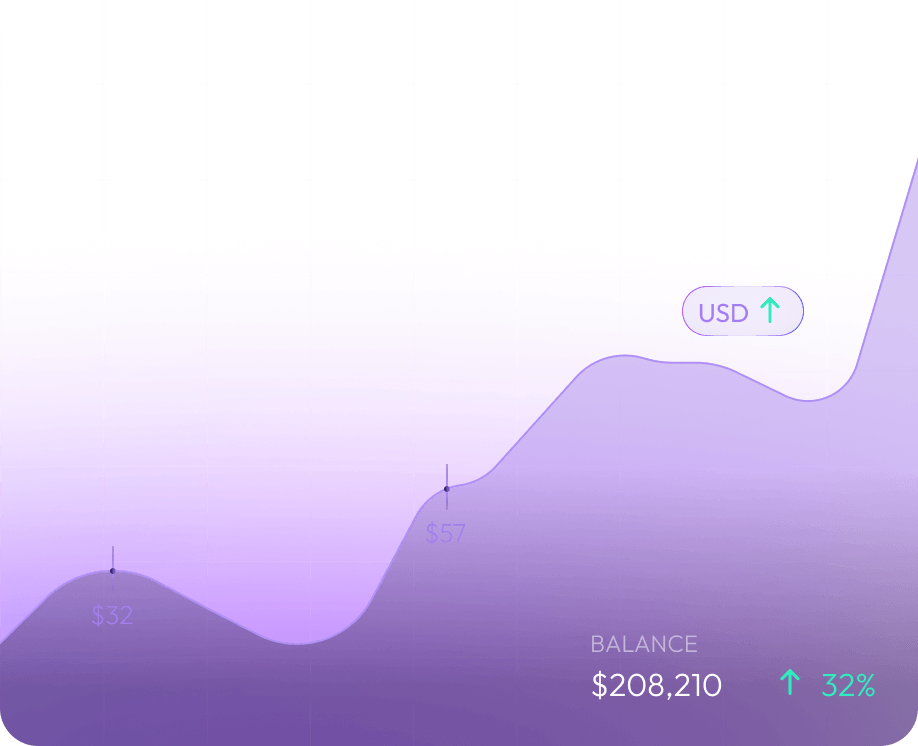

AI Powered Portfolio Growth

Harness advanced AI and institutional trading strategies for effortless, continuous portfolio growth.

Generate Alpha for your Portfolio

How to Invest with Kvants?

Select your Quantitative Strategy

Connect your Decentralized Wallet

Confirm your $KVAI Tier Subscription

Actively monitor your portfolios performance in real time

Quantitative trading is a systematic investment approach that relies on mathematical models, statistical analysis, and algorithmic execution to identify and exploit trading opportunities.

Rather than relying on human intuition, quantitative trading uses data-driven strategies, often processing large datasets to uncover patterns, correlations, and anomalies across various assets.

Unlock the potential of cutting-edge quantitative strategies with Kvants. Our platform leverages advanced algorithms, data-driven insights, and market-neutral techniques to deliver consistent performance, even in volatile markets.

By investing in quant strategies, you gain access to innovative tools that minimize risk while maximizing opportunities across digital asset markets. Whether you’re seeking stability or high-yield potential.

Quantitative trading uses advanced algorithms and statistical precision to eliminate emotional decision-making and maximise efficiency.

Quant strategies find market inefficiencies, execute trades quickly, and adapt to changing conditions by analysing massive amounts of data in real time. Quant trading reduces risk and improves returns with built-in risk management, seamless scalability, and diversification across multiple assets.

Our partners

Kvants in Press & Our Happy clients

FAQ

Can’t find an answer to your question?

Feel free to contact us.

The core product of Kvants.ai is the decentralized asset management platform that offers retail investors access to institutional level tokenised funds.

Kvants.ai has already partnered up with a leading hedge fund strategy, and tokenised its AI Neutral Trading Strategy on the platform.

With many more top-level strategies to come, council members of the KvantDAO will be able to vote on which strategies to tokenise next.

The asset management industry is expected to reach $147.4 trillion by 2025, and the adoption of AI- driven trading strategies could help drive growth in the industry by improving investment decision- making and performance.

The global AI market is projected to grow at a CAGR of 39.7% from 2021 to 2026, with the market size expected to reach $309.6 billion by 2026.

The global quantitative trading market size was valued at $10.31 billion in 2020 and is expected to grow at a CAGR of 9.7% from 2021 to 2028.

Retail investors can benefit from quantitative AI-based strategies to capitalize on market movements, such as volatility, and Kvants.ai aims to bring the best AI-driven trading strategies developed by industry leaders to retail investors via a tokenized basis.

Kvants.ai aims to bring the power of AI-driven algorithmic trading to retail investors' portfolios via an intuitive decentralised asset management platform.

The platform enables retail investors to invest in AI-driven strategies developed by leading hedge funds for as little as $500, making it feasible for regular investors to access the same tools as institutional-level investors.

By tokenising AI-driven strategies, Kvants.ai aims to lower the barrier of entry and enable retail investors to diversify their portfolios into alternative methods that hedge on the volatility of the market and offer investors a new direction from which they can achieve alpha generation for the growth of their portfolios.

AI trading strategies can analyse vast amounts of data and quickly identify patterns and trends that are difficult for human traders to detect, leading to more informed and timely investment decisions.

AI trading strategies can identify opportunities across a wide range of digital assets, providing investors with sufficient diversification and a high Calmar ratio.

AI trading strategies can quickly adapt to changing market conditions and adjust the exposures trading direction in real-time, enabling investors to grasp the competitive edge of market volatility and take advantage of emerging opportunities.

Decentralised blockchain-based AI trading strategies can offer investors greater transparency into the decision-making process and portfolio performance, helping investors to make more informed decisions and build trust in the platform.

The Kvant Analysis on the Kvants platform is a service that allows users to stay up-to-date with current market affairs and updates provided by the Internal Kvant Analysts. This service offers weekly market reports, macro/micro crypto relevant news on global affairs, and detailed Kvant Analyst investment analysis into a new algorithm.

Subscribe to our Newsletter