Invest like the

ELITE

ELITE

ELITE

Investment-enabled marketplace for Quantitative Hedge Fund Strategies

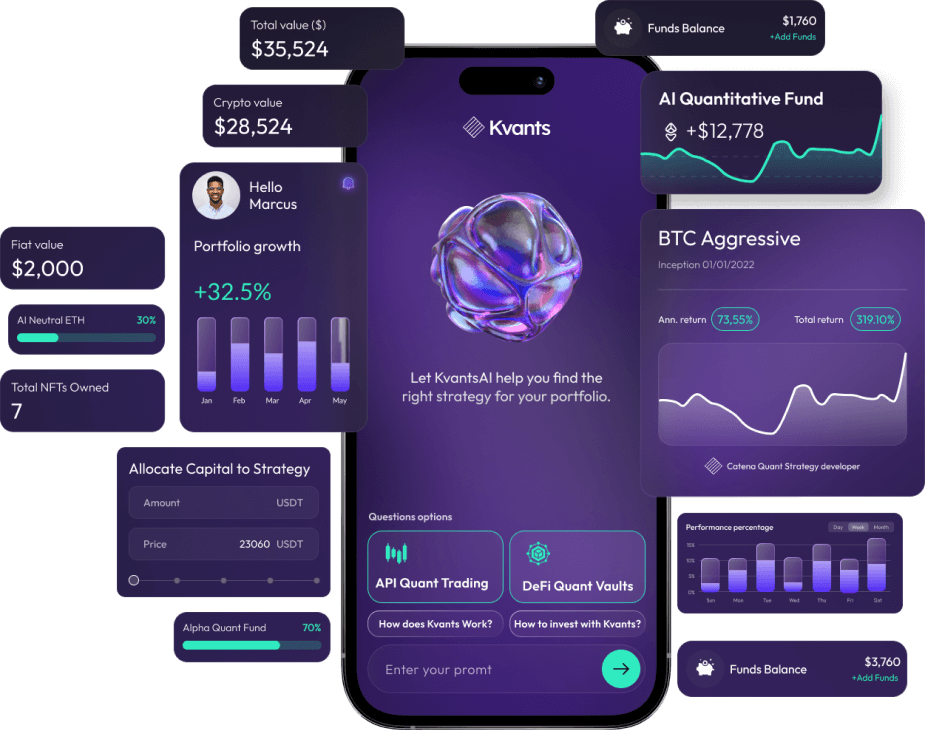

AI-Driven Quant Trading

Kvants redefines HODLing and enables crypto investors to enhance their portfolios with Quantitative trading strategies developed by leading hedge funds.

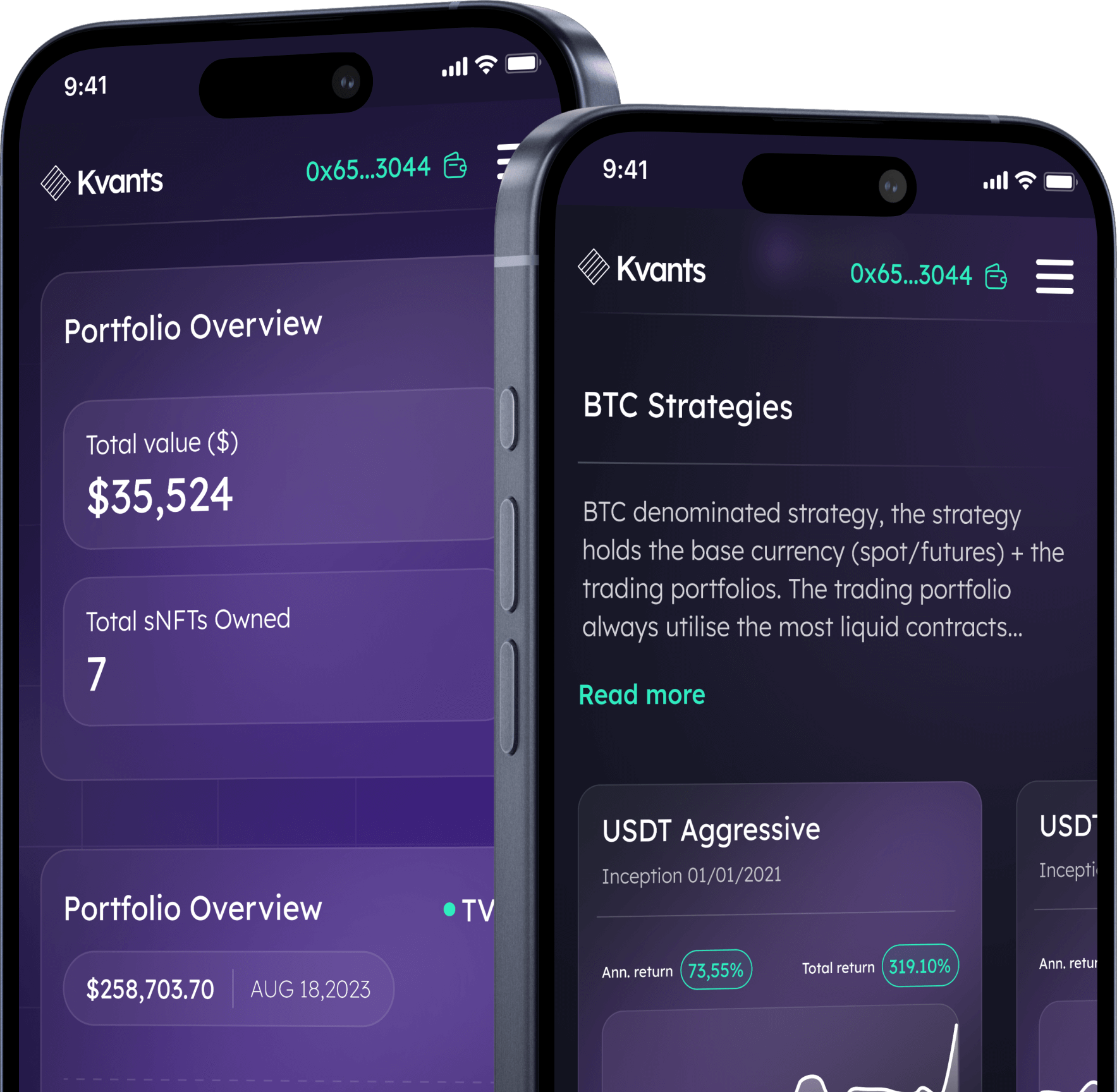

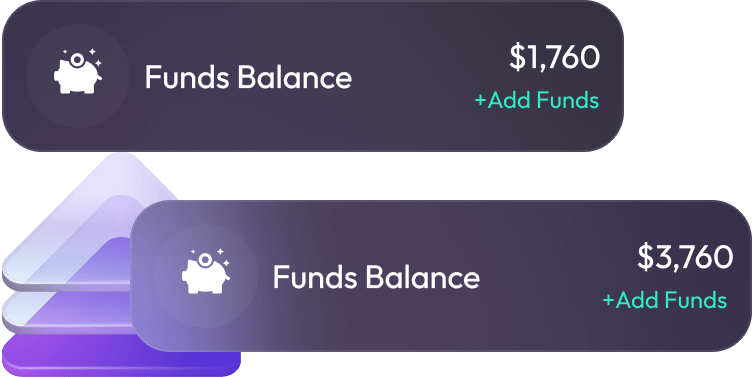

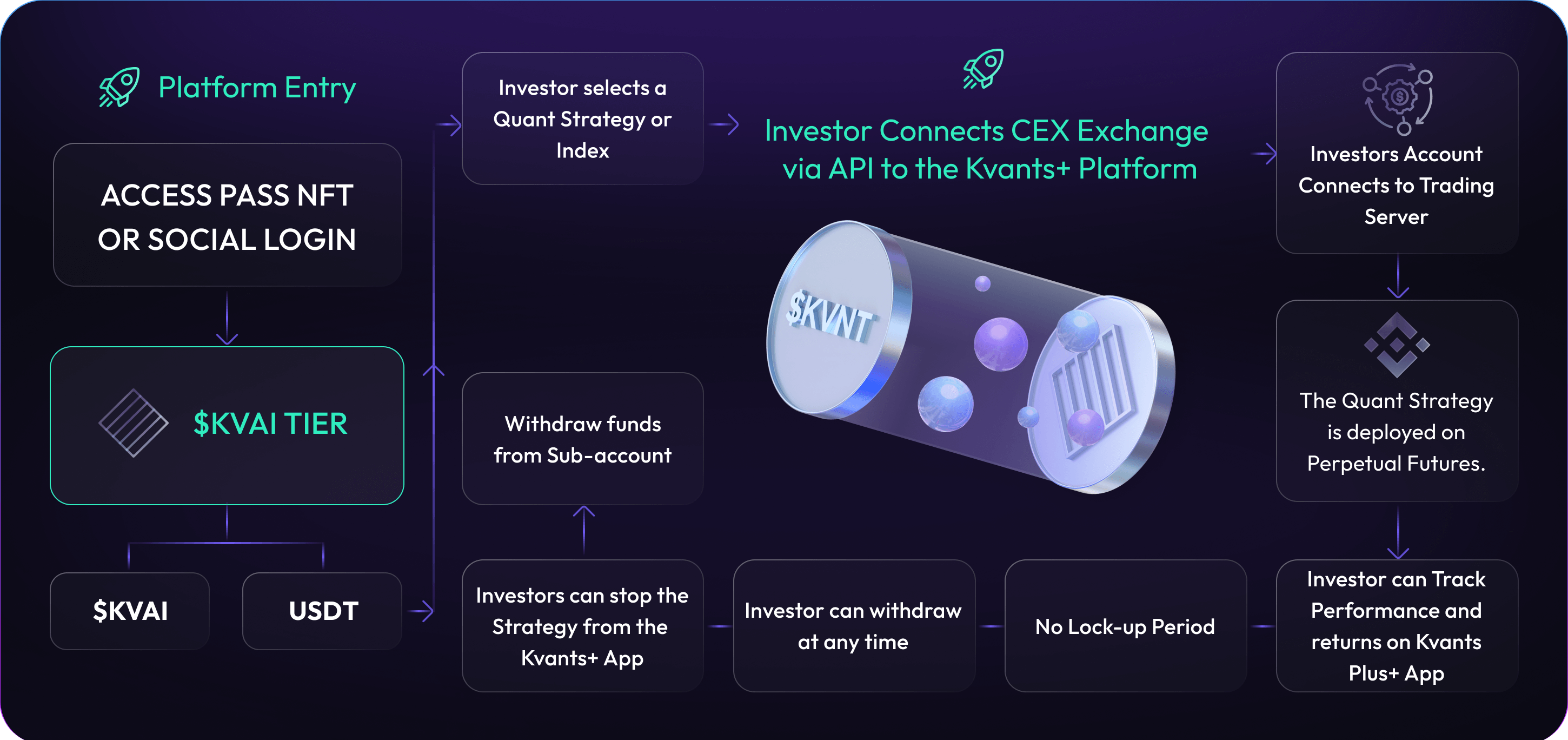

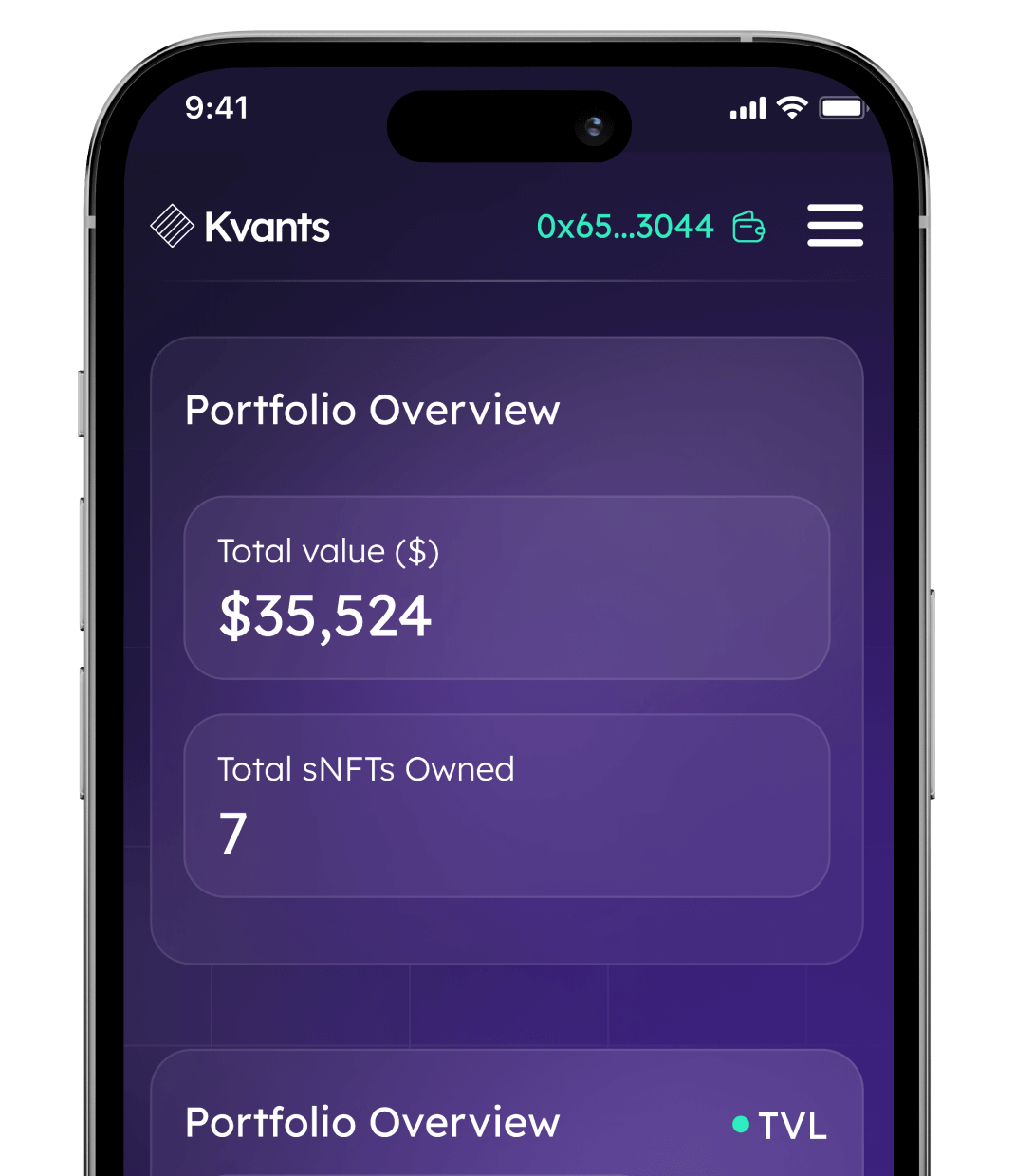

Connect your CeFi Exchange to the Kvants Plus+ App via API

Non-Custodial Omni Chain Quantitative Trading Vaults, powered by the OmniQuant Infrastructure

Invest into Non-Custodial DeFi Quant Vaults that deploy Quant Strategies on DyDx

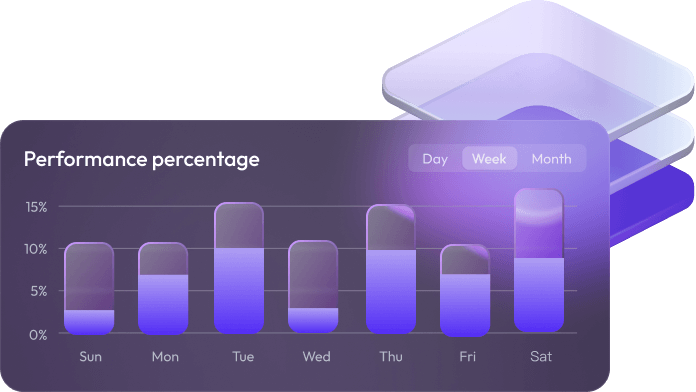

Average compounded annual growth rate of the algorithms available on the Kvants Platform.

Whitelisted participants for our Public Alpha Waitlist

Aggregate AUM of Quant Funds that listed their Quant Strategies on Kvants.

Yearly Return of highest performing Quantitative Strategy available on Kvants

Featured

Quant Strategies

The Enhanced Strategy for Ethereum blends active trading of liquid cryptocurrencies with consistent investment in ETH. It targets alpha returns by exploiting market inefficiencies while maintaining exposure to Ethereum's beta returns. Profits from trades are reinvested into ETH, balancing the pursuit of immediate gains with long-term growth in Ethereum. The strategy employs diversification and adapts to market conditions for risk management, effectively combining short-term profit opportunities with Ethereum's inherent market performance.

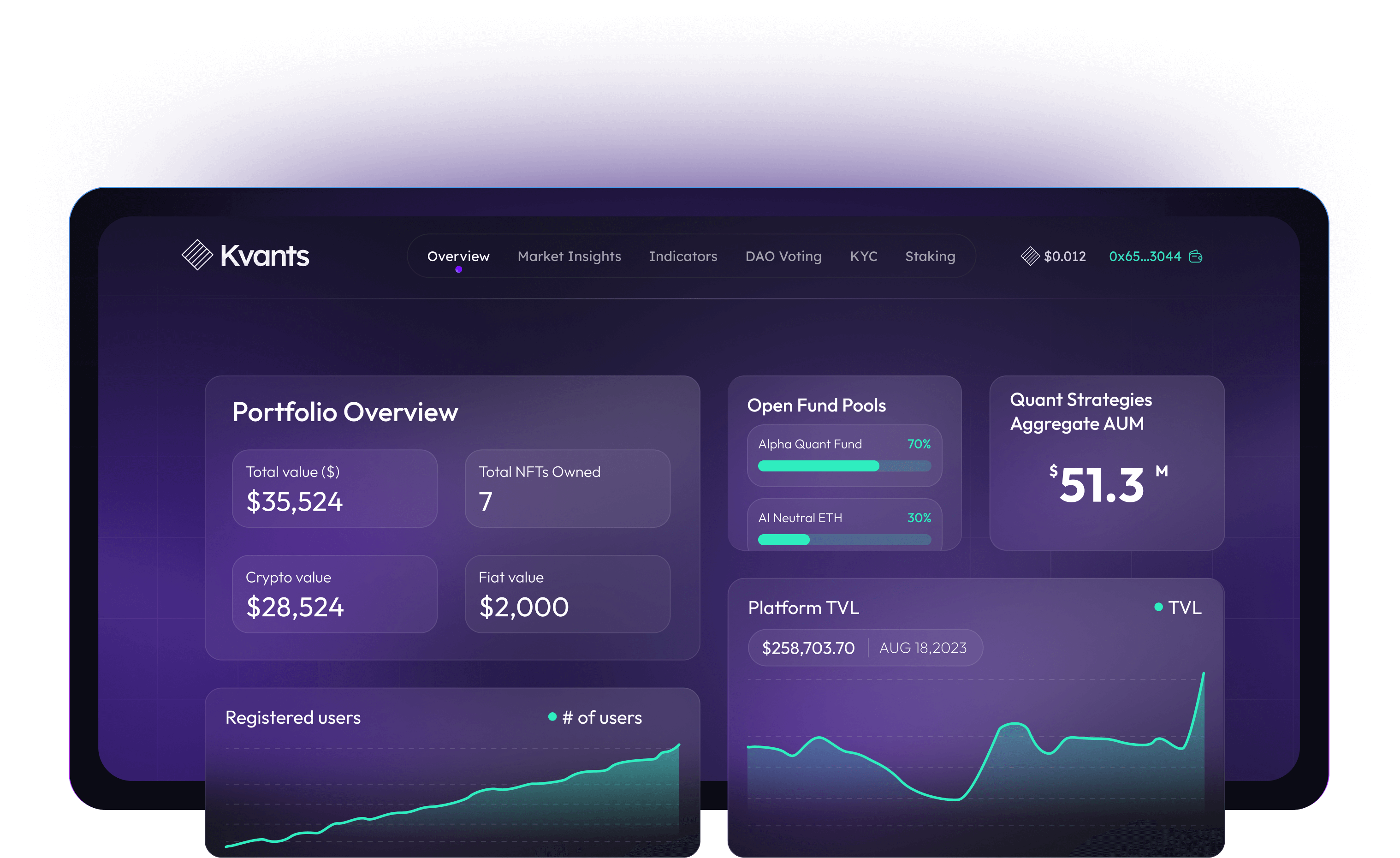

Overview

Kvants brings AI-driven quant Strategies to crypto investors via a sophisticated and easy-to-navigate platform. Select, analyse, and invest in strategies developed by experienced Quantitative hedge funds that integrate artificial intelligence interpretation models into rational trading models.

Kvants emphasizes the due-dilligence into funds we offer on our asset management platform. We perform Institutional grade due diligence into each AI-Driven Quant Strategy offered to investors. Via testing and proof-of-concept, with real capital allocation to verify reported trading returns before offering the strategy on Kvants Plus+.

Features of the Kvants Platform

No-lockup &

No-lockup & Non-custodial

The #1st AI-Enabled Quant Trading Asset Management Platform

The #1st AI-Enabled Quant Trading Asset Management Platform

Access the World of Institutional-grade Asset Management

Access the World of Institutional-grade Asset Management

Talk to RoboQuant

Get recommendations on which Quant Trading strategy or Strategy Index available on our platform will best suit your expected return, risk appetite, and trading style.

Quantitative Strategy Portfolios

Invest in Portfolios made up of multiple Quantitative Trading Strategies to maximise your diversification and alpha generation potential.

Invest into a composition of direction neutral quantitative strategies. That trade using robust mathematical models on top of the 100 most liquid pairs.

Smart Beta Strategies that accumulate more of the underlying asset from Alpha Strategies + You benefit from the Beta returns of the asset.

A Index of Long Only Strategies aiming to maximise your holdings by via volumetric factor models, sell high buy back low.

Investment ecosystems

How to invest with Kvants

Stake a $KVAI Tier that allows you to invest in Quantitative strategies available on Kvants Plus+.

Roadmap

Partners

Frequently asked questions

Kvants.ai is a decentralised asset management platform that offers access to AI-enabled trading strategies. It's a platform that curates industry-leading trading algorithms backed by AI and machine learning to make and support better investment decisions.

It is the leading platform for tokenised machine learning and AI-driven trading strategies.

The platform empowers investors by providing them with access to institutional-level AI trading strategies.Kvants refers to the plural of multiple quantitative algorithms.

Kvants refers to the plural of multiple quantitative algorithms.

The core product of Kvants.ai is the decentralized asset management platform that offers retail investors access to institutional level tokenised funds.

Kvants.ai has already partnered up with a leading hedge fund strategy, and tokenised its AI Neutral Trading Strategy on the platform.

With many more top-level strategies to come, council members of the KvantDAO will be able to vote on which strategies to tokenise next.

The asset management industry is expected to reach $147.4 trillion by 2025, and the adoption of AI- driven trading strategies could help drive growth in the industry by improving investment decision- making and performance.

The global AI market is projected to grow at a CAGR of 39.7% from 2021 to 2026, with the market size expected to reach $309.6 billion by 2026.

The global quantitative trading market size was valued at $10.31 billion in 2020 and is expected to grow at a CAGR of 9.7% from 2021 to 2028.

Retail investors can benefit from quantitative AI-based strategies to capitalize on market movements, such as volatility, and Kvants.ai aims to bring the best AI-driven trading strategies developed by industry leaders to retail investors via a tokenized basis.

Kvants.ai aims to bring the power of AI-driven algorithmic trading to retail investors' portfolios via an intuitive decentralised asset management platform.

The platform enables retail investors to invest in AI-driven strategies developed by leading hedge funds for as little as $500, making it feasible for regular investors to access the same tools as institutional-level investors.

By tokenising AI-driven strategies, Kvants.ai aims to lower the barrier of entry and enable retail investors to diversify their portfolios into alternative methods that hedge on the volatility of the market and offer investors a new direction from which they can achieve alpha generation for the growth of their portfolios.

AI trading strategies can analyse vast amounts of data and quickly identify patterns and trends that are difficult for human traders to detect, leading to more informed and timely investment decisions.

AI trading strategies can identify opportunities across a wide range of digital assets, providing investors with sufficient diversification and a high Calmar ratio.

AI trading strategies can quickly adapt to changing market conditions and adjust the exposures trading direction in real-time, enabling investors to grasp the competitive edge of market volatility and take advantage of emerging opportunities.

Decentralised blockchain-based AI trading strategies can offer investors greater transparency into the decision-making process and portfolio performance, helping investors to make more informed decisions and build trust in the platform.

Kvants differentiates itself from traditional asset management protocols by offering access to top AI- driven trading strategies developed by leading hedge funds. The platform provides greater transparency into the investment process, which can help to build trust with retail investors. It also enables fractional ownership and easy trading in and out of positions, making it more accessible to retail investors.

The Kvant Analysis on the Kvants platform is a service that allows users to stay up-to-date with current market affairs and updates provided by the Internal Kvant Analysts. This service offers weekly market reports, macro/micro crypto relevant news on global affairs, and detailed Kvant Analyst investment analysis into a new algorithm.

The News/Report Platform on the Kvants platform allows users to stay up-to-date with the latest trends, reports, and macro/micro analyses of the global crypto and equity markets. It offers institutional-level due diligence to retail clientele, which can help them gain a competitive edge with their trading and personal portfolio management.

AI-driven trading strategies on Kvants aim to make and support better investment decisions by leveraging the power of AI. They provide a unique opportunity for retail investors to allocate capital in ways that were once only available to a select few. The platform also provides regular strategy performance updates, Q&A sessions, and podcasts with hedge fund managers to help investors make informed decisions.

The Kvants DAO Governance provides a decentralized governance model for the platform where token holders can propose and vote on changes to exclusive rights to receive the monthly payouts from the fund's performance. These NFTs are tradable on open marketplaces and can be bought and sold like any other NFT. Additionally, NFT holders receive discounted performance fees and additional APY distribution when they stake their NFTs on the platform. The NFTs also allow for fractional ownership of the underlying assets, making it accessible to retail investors who might not have been able to invest in the asset directly otherwise.

To subscribe or redeem Kvants AI algorithms, investors can do so via the platform. They purchase an ERC-721 token that serves as the certificate of contribution into the select fund and gives its holder redemption rights once the fund's maturity date has passed.

The platform provides video explainers on the underlying strategy of each AI Trading algorithm to help investors better understand how the strategies work and make informed investment decisions.

An NFT-based fund subscription allows users to subscribe to a fund on a decentralized NFT model basis. By doing so, users can gain access to a range of AI-driven quantitative trading strategies and benefit from their returns.

To use the Kvants platform, users need to complete the full Know Your Customer (KYC) and Anti- Money Laundering (AML) compliance process. This process requires users to verify their identity, and the platform uses third-party verification tools to ensure that the provided information is valid and accurate.

A subscription NFT (sNFT) serves as a subscription certificate giving its holder redemption rights to redeem the accrued alpha generated by the AI-driven trading strategy on the maturity date.

The Kvants platform requires users to successfully pass KYC/AML measures, accommodating the compliance standards required while retaining DeFi and decentralized principles to provide a safe and compliant investment platform for retail investors.

The longer the lockup period of the NFT, the greater the performance fee discount and Kvant bonus the NFT holder will be eligible to receive.

Staking sNFT in a dedicated lock pool makes the staker eligible to receive reward multipliers paid out in $Kvant tokens from the performance fee buy-back scheme and incentives from the $Kvant treasury.

The core revenue generation for the KVANTs platform is derived from the performance of the Quantitative AI algorithms offered in the platform in the form of a performance fee.

The profit generated by the performance fee is used to contribute back to the economic incentivization for the community via the buyback and burn of $KVANT utility tokens, performance- backed APY, and liquidity locks.

The $KVANT token has deflationary token economics, where the $KVANT utility token supply is repurchased via the profits that the AI algorithm generates. Meaning a portion of the platform performance fees generated will be utilized to buy back the $KVANT token from the open market.

AUM growth results in larger token buy-backs from the open market on a monthly basis.

The tokens purchased from the open market are split between redistributed revenue to users who stake their contribution in a locked pool as a productivity-supported APY and partially burned to actively decrease the circulating supply.

Subscribe to our newsletter

We cover topics ranging from web3, crypto, educational investments, AI, blockchain and more.